Owner Account Statements

Owner account statements, available when the OPV_<version number> Opera Vacation Ownership System license code is active, are print, file, email, or fax reports that display disbursements, payments, and owner account balances. Statements are typically prepared at the end of the month, or specified period, to consolidate the owners’ rental revenue and fees. Account balances for owners typically have a negative amount that displays a credit to the owner for rental revenue, showing amounts owed by account holders. Owners with negative balances will be sent a check, owners with a positive balance, will be sent a bill. Opera makes it possible to produce statements on an as-needed basis (this is sometimes called "on-demand"), for either one account at a time or in batch for two or more selected accounts.

Individual owner account statements may be generated "on-demand" via one of two ways:

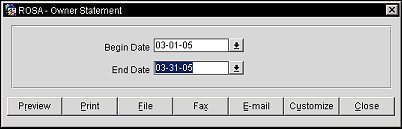

Select the begin and end dates of the period that you want to generate a statement for and then select the Detail, Summary, or Cashbook radio buttons, depending on the format you want the statement in (see also, Understanding Owner Statement Formats). Select the Preview, Print, File, Fax, or Email buttons to generate the statement. If the statement needs to be modified, then select the Customize button. See Customizing Reports for details.

Note: To generate owner account statements in batch, refer to Owner Batch Statements.

Note: if the Auto Invoice Creation function is active, owner account statements can be automatically generated at the end of a period.

The format in which the account statement is generated depends on the radio button selected on the Owner Statement Selection Criteria prompt. The following radio buttons are available:

Detail. Select this radio button to generate a detailed owner account statement.

Summary. Select this button to generate an owner account statement in summary format.

Cashbook. Available when the Owner Cashbook Ownership Group Application Parameter is set to Y and the Ownership>Revenue Pooling application function is set to N, select this radio button to generate owner account information in a format that facilitates an internal audit by State Auditors. For additional information on Owner Cashbooks, see Understanding Owner Cashbooks.

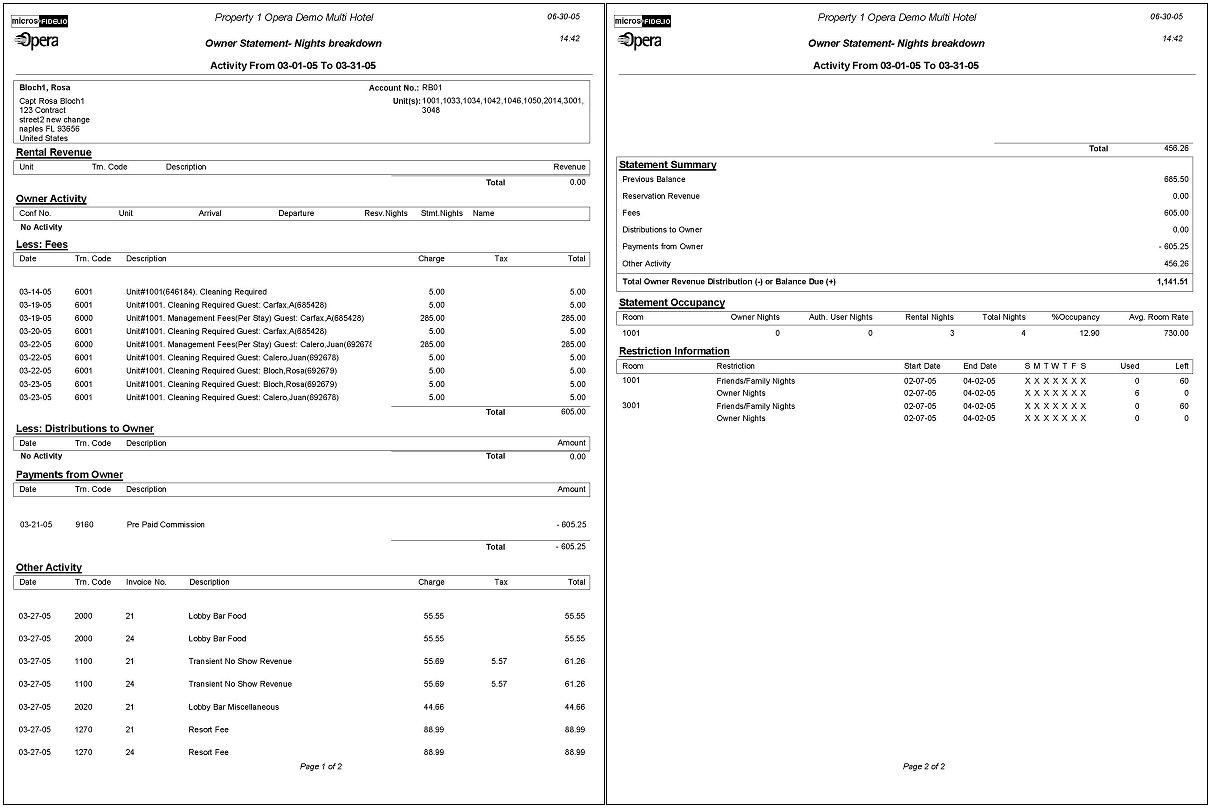

A sample statement is displayed below. If you want to print this topic, it is recommended you print in Portrait format.

Each statement is broken out into the following ten areas:

Header. Displays account header information, including the following details: The owner name and address, the account number, and the unit numbers owned.

Rental Revenue. Displays any rental revenue for the period, including the following details: The rental unit number, the transaction code, a description of the transaction code, the revenue generated for the stay, and the total rental revenue earned.

Note: For a reservation that gets checked into a unit, incurs charges that are not eligible as owner revenue transactions, and then this reservation is room moved on the same date into another room/unit, the reservation will not be visible on the owner statements. If however the charges incurred before the room move do account for eligible owner revenue transaction codes, these will remain visible on the owner statements with an equal Arrival and Departure date even though the reservation was not a Day Use reservation.

Restriction Information. Displays restriction information for the period, including the room number, the type of restriction, the start date and end date, a grid displaying the days of the week that the restriction applies, the number of nights used, and the number of nights left.

In addition, the statement displays the name of the property, the date and time that the statement was produced, and the dates of the period.

See Also